North America is a huge market for plant milks

Figures correct as of September 2019.

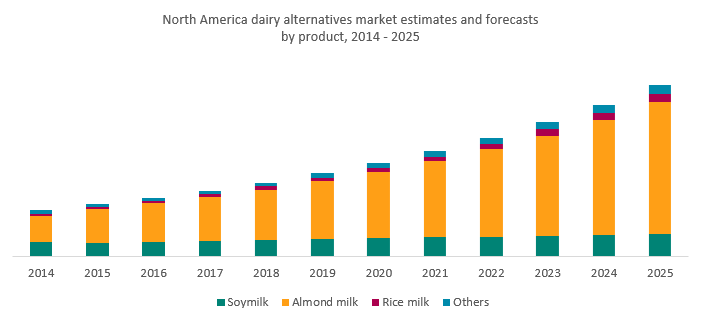

Worldwide, North America is the second-largest segment for plant milks. Valued at nearly $4,500 million in 2019, this region currently holds 25% of the global market. It should be noted that this global dominance may be down to just one ingredient – almonds. The United States leads international almond production, estimated to produce over 80% of the global yield. This places them as key players in the plant milk market. However, concerns have been raised about what this mass cultivation does to local environments.

Despite these concerns, and perhaps unsurprisingly, the almond milk segment is set for the strongest growth between 2020-2025. The United States produces around four times as many almonds as the next highest producer – Spain – with California accounting for the large majority. America has a strong almond heritage, securing its place in the market for years to come.

Growing at a slightly lesser rate is the ‘others’ category, which consists of a variety of plant milks including cashew, oat and coconut. In North American schools, flavoured milk accounts for over 70% of dairy milk sales and the market for flavoured plant milk is also growing well. This could present an opportunity for plant milk producers to profit from an already established market.

Next in terms of estimated growth is the rice milk segment. Rice milk is naturally sweeter than other plant milks and hence can appeal to sugar-conscious consumers.

Lastly, there is soy milk, which is estimated for stagnant growth in the coming years. North America is a global leader in soya bean production, particularly within the upper Midwest regions in the United States. However, the large majority of this is used to feed farmed animals and not used for human consumption.

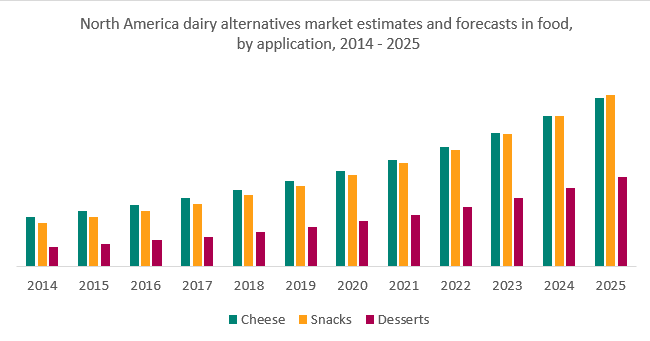

In 2019, food products accounted for nearly 40% of the dairy alternative market in North America. The vegan dessert category holds the smallest percentage of this but is expected to see the strongest estimated growth rate between 2020-2025. Whilst it depends on the type of ingredients used, plant milks tend to be lower in calories and fat compared to dairy. This leads them to be an attractive option for dessert makers, able to achieve healthier options whilst maintaining indulgence.

The snacks category is also set for strong growth in the coming years. In fact, the overall snack market continues to see double-digit growth in North America, with those touting health claims benefitting the most. Almonds have recently claimed the top spot for North Americans snacking preference; hence, products such as almond butters have an established supporter base.

Lastly is the vegan cheese category, which has the lowest estimated growth rate of the three, although the figure is still significant. Rising consumer demand for fast food, ready-meals and food-to-go options will likely aid the growth of this category. Restaurants chains across North America are ramping up on their vegan offerings, bringing veganism to the mainstream and making it easier than ever to make the switch.

Data from Grand View Research, Inc.

USA plant milk market

The USA is a global leader in the plant milk market

Figures correct as of September...(Read More)